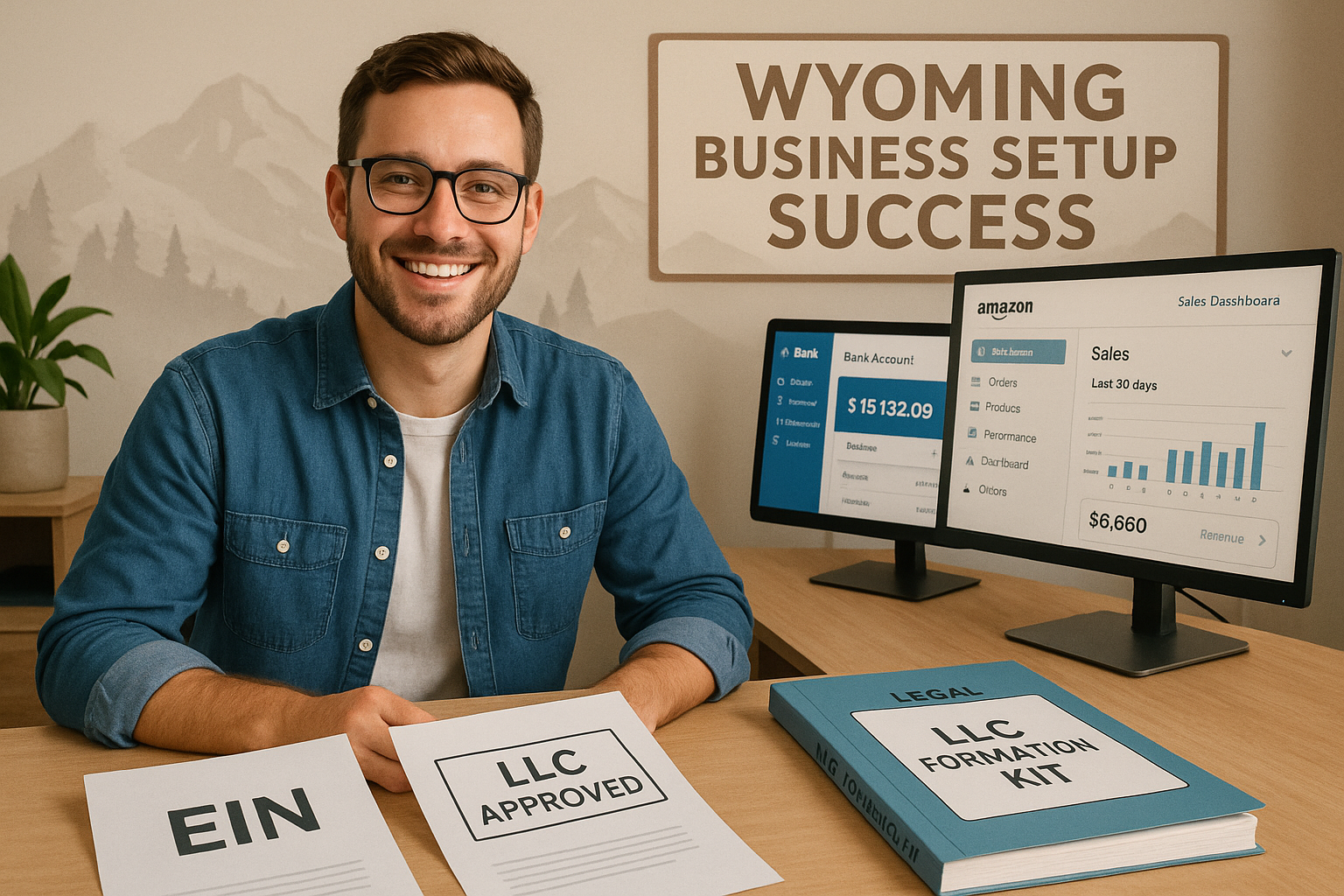

If you’re running an online store or managing an Amazon FBA business, one smart move could save you thousands in taxes and headaches—forming a Wyoming LLC for e-commerce with Leegal LLC.

As someone who’s helped dozens of entrepreneurs and e-commerce founders register their U.S. companies, I can tell you this: Wyoming isn’t just a state with great national parks—it’s also the gold standard for small business-friendly LLC laws. And for online sellers, it’s even more powerful.

Let’s unpack why setting up your e-commerce business in Wyoming might be the smartest decision you’ll make this year.

Table of Contents

ToggleWhy a Wyoming LLC for E-commerce is a Game Changer

When you’re selling products online—whether via Shopify, Etsy, WooCommerce, or Amazon FBA—you need a business structure that gives you flexibility, privacy, and tax advantages. A Wyoming LLC for e-commerce offers all that and more.

Personally, I’ve seen clients who were struggling with compliance and high costs in their home state breathe a sigh of relief after switching to a Wyoming entity. No franchise taxes, minimal annual fees, and no complicated reporting requirements.

Here’s why this matters if you’re in the trenches of e-commerce.

1. Zero State Income Tax = More Profits for You

Let’s start with the money.

Wyoming doesn’t have a state income tax. That means your LLC income stays untouched at the state level, leaving more for you to reinvest, scale your business, or even just breathe easier during tax season.

💬 First-hand tip: One Amazon FBA seller we worked with saw an instant improvement in cash flow by relocating their business from California to Wyoming. No more dealing with complicated state returns and high state taxes.

2. Unmatched Privacy Protection for Online Sellers

If you value your privacy (and who doesn’t?), Wyoming has your back.

When you form an LLC in Wyoming, your name doesn’t have to appear in public databases. That means fewer spam calls, no random mailers, and a much stronger layer of personal protection.

So if you’re a solo Amazon FBA entrepreneur or small team selling dropshipped goods, a Wyoming LLC shields your identity while keeping your business legally sound.

3. Asset Protection that Makes You Sleep Better

Ever worried about being sued? Whether it’s a product issue or a customer complaint gone sideways, e-commerce sellers face legal risks all the time.

Wyoming offers strong limited liability protection for LLCs. That means your personal assets—car, house, savings—are protected even if your business runs into trouble.

💡 Pro tip: Even if you operate your e-commerce business from another country, forming a Wyoming LLC gives you access to U.S. legal protections.

4. Low Annual Fees and Simple Maintenance

Running an online store is already a hustle—you don’t need a state that piles on paperwork and fees.

Unlike states like California or New York, Wyoming keeps it simple:

Annual report fee? Just $60.

No complicated tax filings.

No state-level bookkeeping audits for LLCs.

That’s peace of mind and less admin stress, especially during high-volume e-commerce seasons like Black Friday or Q4 on Amazon.

5. Easy U.S. Bank Account and EIN Setup

To run your online business professionally, you need a U.S. bank account and an EIN (Employer Identification Number).

When you form your Wyoming LLC through a trusted partner like Leegal LLC, both are included:

EIN tax ID is obtained directly from the IRS.

Digital business bank account (perfect for Stripe, PayPal, Amazon payouts).

No need to fly to the U.S.

👉 First-hand experience: We’ve helped non-resident founders from India, Germany, Brazil—even Nigeria—set up their Wyoming LLCs without ever leaving home.

6. Ideal for Amazon FBA Sellers & Global Brands

Amazon has strict rules for business verification. If you’re using Amazon FBA, they may ask for:

Business formation docs

Tax ID (EIN)

U.S. address

Bank account in your business name

A Wyoming LLC for e-commerce ticks all the boxes. And when you launch with Leegal LLC, you get:

✅ Name check & clearance

✅ Registered agent (1 year)

✅ Articles of incorporation

✅ Digital access to docs

✅ Business mailing address

✅ U.S. digital bank account

✅ Mailroom access & EIN

No hidden charges. Just One Price, No Surprises.

7. No Need to Live in the U.S. to Reap the Benefits

Here’s a fun fact: You don’t need to step foot in Wyoming—or even the U.S.—to own and run a Wyoming LLC.

That’s why international e-commerce sellers love this setup. Whether you’re running a Shopify store from India or managing Amazon inventory from Mexico, you can legally and efficiently operate your U.S. business from anywhere.

Why Form an LLC in Wyoming Instead of Your Home State?

Let’s directly answer this burning question: why form an LLC in Wyoming rather than your state (or country)?

Here’s a comparison:

| Feature | Wyoming LLC | Home Country Entity |

|---|---|---|

| State Income Tax | ❌ None | ✅ Usually applies |

| Public Disclosure | ❌ Private | ✅ Often required |

| Filing Simplicity | ✅ Super Easy | ❌ Often complex |

| Foreign Ownership Friendly | ✅ 100% OK | ❌ Restricted |

| Annual Costs | ✅ Very Low | ❌ Can be expensive |

If you’re an e-commerce seller trying to stay lean and agile, Wyoming wins hands down.

Conclusion: Ready to Launch Your Wyoming LLC for E-commerce?

Starting or relocating your e-commerce business to Wyoming isn’t just smart—it’s strategic.

You’ll save on taxes, reduce compliance headaches, gain privacy protection, and be fully set up for U.S. e-commerce platforms like Amazon, eBay, Walmart Marketplace, and more.

With Leegal LLC, you get the full package:

✅ EIN

✅ Bank Account

✅ Articles

✅ Registered Agent

✅ All documents

✅ Lifetime support

✅ No hidden fees

Form your Wyoming LLC for e-commerce today—because smart founders build with structure, not stress.

FAQs – Wyoming LLC for E-commerce Sellers

Q1. Do I need to be in the U.S. to open a Wyoming LLC for e-commerce?

No! You can form your LLC completely online. With Leegal LLC, you’ll get everything handled remotely—including your EIN and bank account.

Q2. Can I use a Wyoming LLC to sell on Amazon FBA?

Absolutely. A Wyoming LLC is fully accepted by Amazon and even preferred due to its clarity in legal and tax structures.

Q3. Why form an LLC in Wyoming and not in my home country?

Wyoming offers better privacy, zero state income tax, and easier U.S. platform integrations. Your local entity might come with more red tape and less flexibility.

Q4. Is Wyoming the best state for an Amazon seller?

Yes—for most small businesses and FBA sellers, Wyoming offers the best mix of tax efficiency, privacy, and ease of setup.

Q5. How much does it cost to form a Wyoming LLC with Leegal LLC?

With Leegal LLC, it’s One Price, No Surprises. Everything from state filing to EIN and banking is included. No upsells, no hidden charges.